Introduction

ABSTRACT: Perpetual commodity vaults provide investors an inflation hedged return backed by a legal contract secured on underlying farmland. LandX makes commodity vaults available as a liquid digital asset.

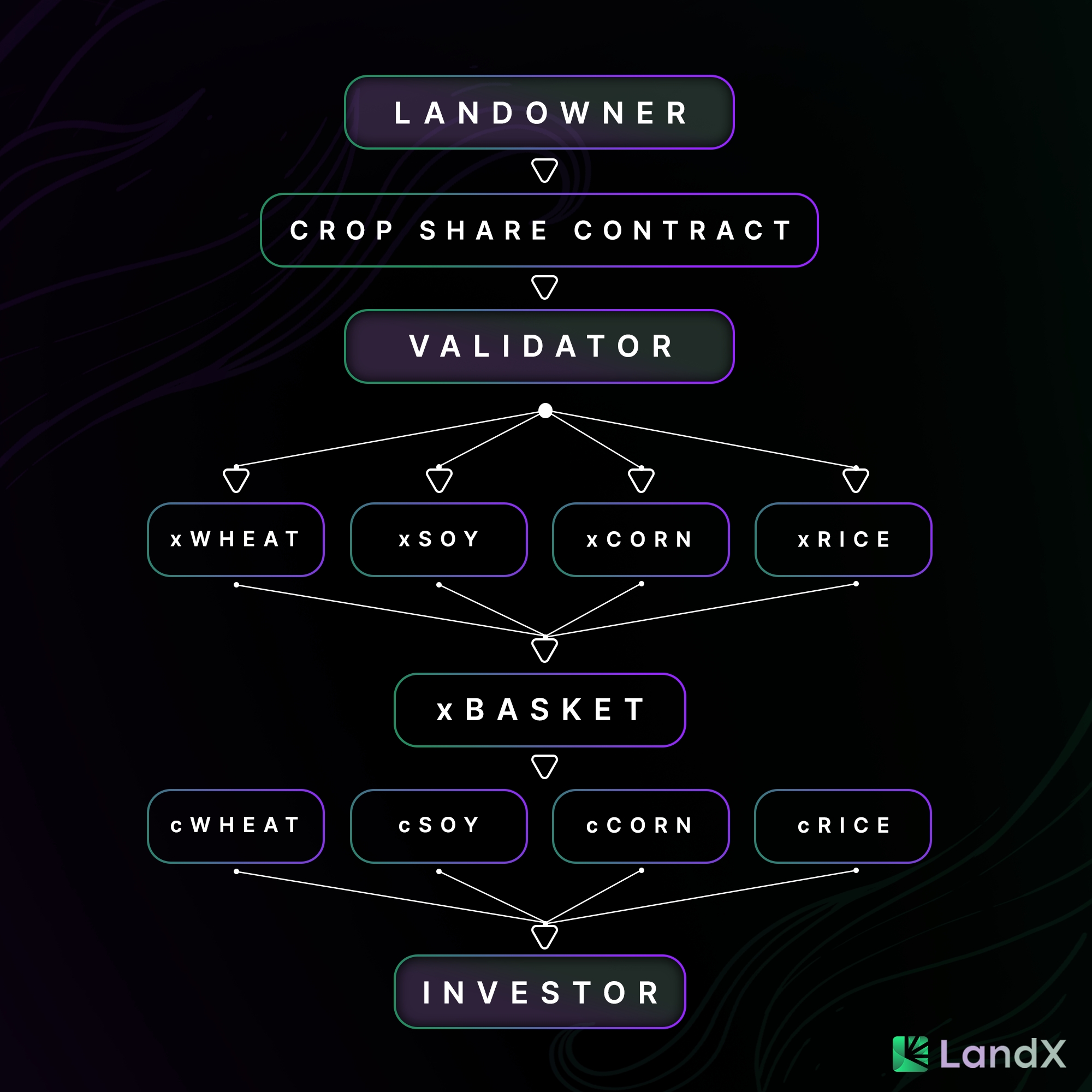

LandX offers tokenized commodities and perpetual vaults for agricultural products.

xTokens are perpetual commodity vault paying out 1 cToken per year in yield.

cTokens are on-chain commodities representing 1KG of the underlying product.

The xToken perpetual yield is derived from 49-year rolling legal crop share contracts called liens, secured by farmland and managed by validators.

An internal marketplace offers cToken/USDC liquidity enabling users to trade commodities without slippage at an oracle set rate.

At launch there are four markets representing the most important and widely traded agricultural commodities: Wheat, Soy, Corn & Rice.

xBASKET is an ERC20 index fund token which represents a basket of equally weighted xTokens. Initially each xBASKET = 0.25 xWHEAT + 0.25 xRICE + 0.25 xCORN + 0.25 xSOY.

Overtime due to its self-compounding mechanism, the yield generated from the xTokens is automatically reinvested to acquire additional xTokens so that quantity of xTokens in each xBASKET gradually increases over time.

Users can at any time mint or redeem their xBASKET for the individual underlying xTokens.

LandX provides the opportunity to generate real yield, from real production and bring that on-chain to create sustainable DeFi incentives.

cTokens & xTokens are liquid digital assets traded 24/7. cTokens value derives from the market value of the commodity. xToken value derives from investors pricing of the vault. If the value of wheat goes up then the amount of yield paid per year per xToken increases.

In traditional finance agricultural products account for 5% of derivative trading volumes. LandX has a first mover advantage in DeFi.

LandX provides landowners with the upfront capital required to grow their businesses, invest in equipment and modernize their production capabilities. It is more flexible, efficient and fair than the traditional financing that is currently available.

For investors LandX provides exposure to an uncorrelated digital asset which acts as an inflation hedge and brings real yield to DeFi markets.

Last updated