Liquidity Provision

xTokens are traded primarily on Uniswap, the most popular decentralized exchange. Their pricing is dependent on supply, demand, and liquidity provisions.

An LP (liquidity provider) will deposit a pair of assets to a liquidity pool in order to earn trading fees on that pair.

For example, an LP can provide xSOY and USDC to the xSOY/USDC market on Uniswap. A trader can then come along and purchase the xSOY token with USDC (or another token that would be routed USDT > USDC > xSOY).

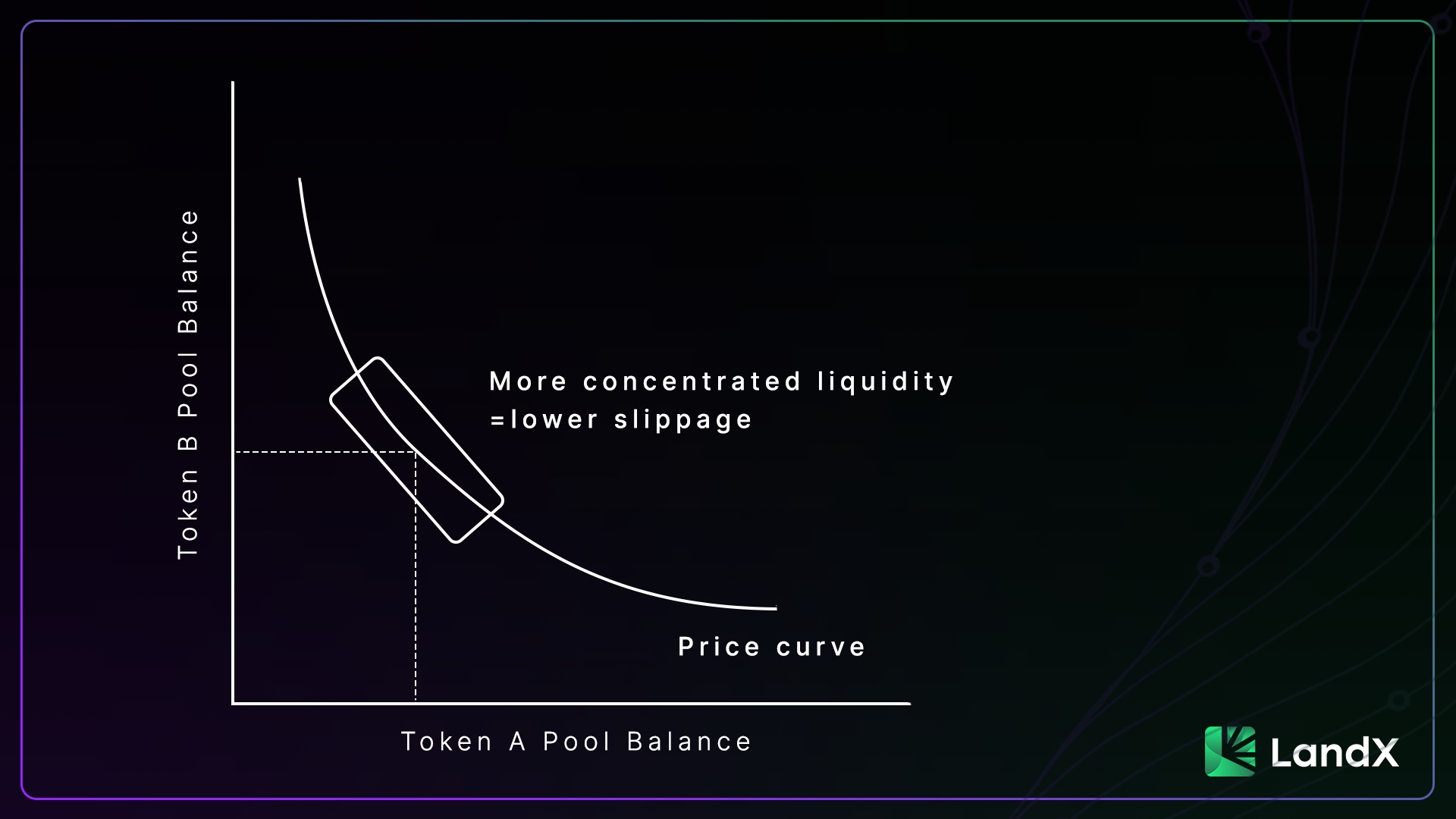

This increases the balance of USDC in the xSOY/USDC pool and decreases the amount of available xSOY. This imbalance in the pool creates a shift in the price using the constant product formula:

x × y = k

x and y represent the pool balance of each token, and k is the total constant price of the pool creating the following price curve.

Liquidity providers earn trading fees for providing this service at a rate of 0.3% per trade on standard pools.

Current commodity prices per KG as of July 2022 for price calculations.

Wheat- $0.35/kg

Soy - $0.57/kg

Corn - $0.31/kg

Rice-$0.42/kg

xBasket - $0.41/kg (average)

Initial prices can be calculated to target a 7% annual yield.

xTokenPrice = CommodityPrice ÷ 0. 07

The LandX team will create the following pools initially and supply seed liquidity as described below.

Exact amounts are subject to change based on commodity prices at time of deployment.

Seed liquidity will be divided into two positions for each pool. 68% will put in a concentrated range to create a stable price. 32% will be put in a broad range to create wide liquidity in case of sudden spikes in demand².

Liquidity provisions will be managed on an ongoing basis with the aim of creating stable pricing relative to the underlying agricultural asset prices.

² - Based on work by Guillaume Lambert https://lambert-guillaume.medium.com

Last updated